|

| Perhaps its better not to look |

I recently read Tony Judt's Ill Fares the Land, a well-composed indictment of the stagnancy of political dialogue and a poignant discussion of the slow collapse of civil society in the West. Judt briefly comments on taxation as a collective problem in his discussion of community and the sense of common purpose necessary for a well-functioning government:

"All collective undertakings require trust... Taxation is a revealing illustration of this truth... there is an implicit relationship of trust and mutuality between past taxpayers and present beneficiaries, present taxpayers and past and future recipients- and of course future taxpayers who will cover the cost of our outlays today. We are thus condemned to trust people we don't know today, but people we could never have known and people we shall never know, with all of whom we have a complicated relationship of mutual interest.

There is quite a lot of evidence that people trust other people more if they have a lot in common with them: not just religion or language but also income. The more equal a society, the greater the trust... In complex or divided societies, the chances are that a minority - or even a majority - will be forced to concede, often again its will. This makes collective policymaking contentious and favors a minimalist approach to social reform: better to do nothing than to divide people for and against a controversial project... You cannot institutionalize trust. Once corroded, it is virtually impossible to restore."The relevance to the Italian situation will soon become clear, if it isn't already.

Rampant tax evasion and a sizable shadow economy are well known features of the Italian economy, with the informal sector thought to be somewhere between 20-30% of GDP, surpassed in the EU by only Greece and just behind Portugal. The ubiquitous shadow economy's impact is difficult to assess as the majority of the proceeds quickly find their way into the open economy but its depth and breadth speak to the lurking structural problems that plague Italian civil society. Rampant under reporting of income seems to be readily visible: reportedly half of boats over 35 feet are registered to owners reporting income below €26,000, while 604 aircraft owners had income between €26,000 and €65,000. The Ministry of Finance itself estimates that almost 20% of income is undeclared while outside observers suggest the share could be as high as ½. The MOF’s figures imply about €120 bn in lost tax receipts (~8% of 2010 GDP) but the ultimate costs of the highly evolved and well-established informal sector are far deeper, touching all levels of society and fostering a culture of corruption and illegality that undermines the legitimacy of the state and severely hinders the ability to govern.

|

| I had my first encounter with the Italian black market about 30 feet from where this was taken |

There is a fairly substantial body of work on tax evasion in general and much has been written about the particularities of the Italian case. The literature reaches somewhat varied conclusions but the general suggestion is that, as one would intuitively expect, a rising fiscal burden will generally lead to more evasion, although non-economic factors (‘tax morale’) have a significant and potentially overriding impact. Assessing the determinants of tax morale is an obviously theoretical exercise, but if we set aside cultural considerations, fairness of the tax system, reciprocity, and trust in the government and the legal system have all been found to be important variables in determining evasion. While we have a strictly limited ability to accurately measure and compare these variables, they are worth keeping in mind when examining the tax regime. With that caveat, and setting aside the difficult process of disentangling the causal relationships between these factors, we proceed on to the features of Italy in particular.

In Italy, there are a number of structural factors that play a role in shaping evasion behavior, primarily relating to the nature of Italian business as well as to civic and social considerations, particularly the weakness of the judiciary. High taxes, the large number of small firms, and the high number of self-employed in Italy are all factors correlated with high levels of evasion. We will discuss these factors specifically before moving on to examine some of the regional inequalities in wealth and quality of public insititutions that create further hurdles in the Italian case.

|

| Yachting: Still not a past time within reach of the middle class |

Some of the more recent research points to some especially problematic implications. Over time, a fairly constant 10-11%/GDP fiscal ‘overburden’ (i.e. the additional share of taxes on compliant taxpayers) is observable, which seems to suggest that evasion is persistent as cheaters quickly learn to work around new policies. With much of the research on tax morale suggesting that taxpayers’ perception of the fairness of the system plays an important role in shaping tax morale, this implies that correcting evasion will require not only better enforcement mechanisms but shifting long-held attitudes of some Italians. While the persistence of this gap at least offers some suggestion that a relatively fixed proportion of the population are unwilling to cheat it also implies that a static portion of society considers taxes an unfair burden. The well-known plight of young people adds support for the ‘tax morale’ concept, as the measurably disenfranchised youth are also significantly more likely to evade taxes, with many forced to take menial jobs in the informal economy.

The historical experience seems to verify the deep-seated nature of tax evasion, as prior reforms have had a mixed record despite some apparent successes registered in the late ‘90s. These were achieved through a systematic overhaul of the tax system, culminating in the 1997 restructuring of the fiscal authority. The four large tax amnesties (’82, ’91, ’94, ’02) that preceded today’s seem to have had little long-run impact in lowering evasion and may have further undermined the credibility of the government. Some of the empricial evidence suggests this is unsurprising, as combating evasion effectively will require not only new incentives to comply (i.e. tax amnesties) but ultimately lower tax rates in order to make the long-term adjustment costs more bearable for firms, rather than just a one-time benefit. While the significant degree of evasion means there is scope to lower taxes without impacting tax receipts if compliance was higher, there is obviously a significant commitment problem here that will be difficult to resolve.

There is a lot of interesting data to dig into that can be used to consider the efficacy of Monti's tentative reforms. Analysis of survey data suggests that some 90% of untaxed transactions are for amounts <€1,000, suggesting that the edict reducing the maximum cash transaction to €1,000 will have little impact, setting aside concerns of transaction ‘structuring’ and the obvious difficulties with enforcement. On the other hand, expanding the INPS could offer one solution, as there is some evidence that revenue agents are incentivized to maximize their individual success rates by picking easy targets rather than to recover the maximum possible amount of funds, which suggests that despite large expenditures on the revenue service more could be done to enhance its efficiency. Safe to say there are no easy solutions here and effective reform policy will require innovative policy solutions with sufficient credibility to overcome a number of deep-rooted structural factors.

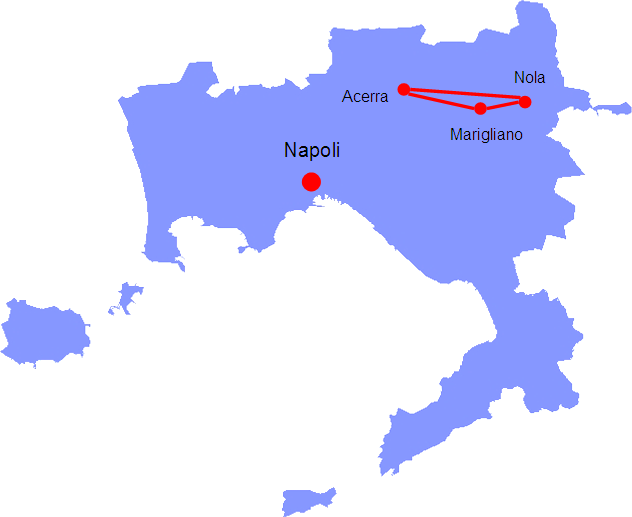

Thought to be between 5-7% of GDP and dominated by a powerful core of criminal syndicates- the internationally infamous mafias- the ultimate impact of the criminal sector is obviously difficult to observe, but is likely to be even larger as it is firmly entrenched in political and economic life. While most powerful in the Mezzogiorno, their native southern states (Sicily, Calabria, Campania, and to lesser extent Apuglia, which together comprise almost 20% of Italian GDP), mafiosi are everywhere in Italy, with what is thought to be a moderate presence in Rome, Milan, Turin, and Brescia:

The impact of the mafiosi on economic activity shows up in the data on FDI in Southern Italy – while FDI in Italy is fairly low by European standards (about 40% below comparable regions), it is abysmally low in Southern Europe, which despite accounting for 7% of manufacturing, and more than half of the population attracts just 0.2% of Italian FDI. With significantly lower labor costs and large underutilized industrial zones, this suggests that outside investors are well aware of the dangers of getting involved in a region dominated by extra-governmental interests.

|

| The so-called 'triangle of death', named for unusually high incidences of cancer, thought to be related to illegal waste dumping by the mafia |

Der Spiegel recently carried a particularly interesting piece on ‘Ndrangheta which is well worth a read. While American readers may be more familiar with the Sicilian Cosa Nostra, the Calabrian ‘Ndrangheta have emerged as the dominant mafia organization in Italy and are rumored to have a tight hold in the European cocaine market. On a somewhat positive note, part of 'Ndrangheta's rise is explicable by the comparitive success in prosecuting other mafia organizations in Italy, at least in part due to better witness protection programs and reduced punishments for collaborators or pentiti. The unfortunate corollary of this is the fact that 'Nrangheta, which relies on family bloodlines to maintain its culture of omerta, has been especially effective at maintaining loyalty, with Calabria accounting for less than a third of the number of mafia convictions in Calabria and Sicily each. A recent diplomatic cable from the American Consulate in Naples paints a dismal picture of in the influence of the 'ndrine- via wikileaks:

"If it were not part of Italy, Calabria would be a failed state. The 'Ndrangheta organized crime syndicate controls vast portions of its territory and economy, and accounts for at least three percent of Italy's GDP (probably much more) through drug trafficking, extortion and usury. Law enforcement is severely hampered by a lack of both sources and resources. Calabrians have a reputation as a distant, difficult people, and their politicians are widely viewed as ineffective.

Most of the politicians we met with on a recent visit were fatalistic, of the opinion that there was little that could be done to stop the region's downward economic spiral or the stranglehold of the 'Ndrangheta. A few others disingenuously suggested that organized crime is no longer a problem. Nearly every interlocutor complained that the region lacks a civil society.

Organized crime is not considered an emergency in Italy, [Catanzaro's Chief Prosecutor] Lombardo observed: 'It is a stable factor in our country. We are accustomed to losing part of our GDP to organized crime and we factor it in to our economic planning.' In Calabria it is nearly impossible to avoid paying extortion or collaborating with the 'Ndrangheta, he went on; 'People are victims and accomplices at the same time.'"The most troubling aspect of organized crime in Italy however is the degree of integration between the mafias and the otherwise largely legal economy, both formal and informal. Reflecting on Roberto Saviano's Gomorrah, Federico Varese at of the Centre for Criminology at Oxford describes the close relationship between legitimate business and the mafia in Campania, the Camorra, who are likely the penultimate mob force after the 'ndrine:

"In the raw and unadorned language of Saviano, the Camorra is not just a collection of purely parasitic, extortionary thugs, but rather an organisation that provides genuine services, such as access to cheap loans, a degree of competition among firms, and enforcement of economic agreements. The caveat is that these services are provided with utter disregard for fairness, freedom to choose, property rights, and a rule-based system of social relations. What is mutual advantage for vast sectors of the local economy produces a collective nightmare for the overall society. It is a quintessential n-person Prisoner’s Dilemma, in which everybody starts off by maximising his own utility and ends up in the worst of all possible worlds, a universe of defection, mis-trust and fear that ultimately strengthens a criminal organisation that has claimed so many lives."Control of transport firms and an ability to determine which products are carried in shops and supermarkets force food producers to negotiate directly with Camorristi , albeit to their mutual advantage, as firms operating under protection can vastly increase sales at their rivals' expense (see the case of Parmalat and Bauli). Underground contracting of production to small, often single-person firms that operate outside of the shadow economy is frequently reliant on mafia-provided trade finance, particularly in the contract production of fashion houses, much as was formerly the case in New York's garment district of old. This is also true of larger firms, who can secure cheap financing from the Mafia in exchange for providing an outlet for the investment of unlawful income and acting as lawful bidders in rigged public works contracts. The mafia's role as financial intermediary even extends to offering investment opportunities for ordinary people, who are encouraged to put their savings into the high-return drug market. The fact that some outsiders benefit from these arrangements despite the large social costs contributes to an attitude among some that the mafia are a tolerable and inevitable part of society- they do after all provide some social goods, albeit in brutal fashion, including the punishment of sex offenders and the killing of AIDS patients to prevent the disease's spread. Indeed, some in the political class regard organized crime as a useful tool for maintaining public order which insures the survival of the more marginalized portions of society, creating social acceptance that sometimes borders on open legitimacy. While there is some support that the undeground economy at large serves as something of a relief valve during economic downturns, the evidence is fairly unequivocal in determining that the ultimate long-term impact is strongly negative, the corrosive impact on civil society and government aside.

Reforming Italy's legal system would accordingly seem to be critical not only in order to better combat organized crime but also so as to enhance public trust in government as a whole and the tax system specifically. This also calls for greater accountability and an end to the privileged life of the political elite, whose wasteful profligacy cost taxpayers some $38/capita, as compared to $7 in the US. Anita Ramasastray at the University of Washington School of Law in Seattle elaborates:

"Italy has 946 elected members of parliament—the highest number of elected representatives in Europe. In 2009, there was reportedly one MP for every 60,371 inhabitants, compared with one for every 91,824 people in the UK; every 112,502 in Germany; and every 560,747 in the United States. In addition to having the most politicians, Italy also pays them the highest salaries in Europe. Its MPs receive more than $16,000 a month, even before perks. And perks include free phone service, free train and air tickets, and even steep discounts at Rome’s designer boutiques. MPs also have a special pension, which exceeds those of normal civil servants—and they earn such a pension at age 60, if they have served in office for a mere 30 months.Italian members of the European Parliament are also well-paid. In 2009, the basic salary of an Italian MEP was €149,215 annually—double the salaries of the Germans and the British, three times the salary of the Portuguese, and four times that of the Spanish. Moreover, Italian MEPs’ travel expenses are automatically calculated based on the most expensive air ticket to Brussels—without the need for any documentation showing that they actually bought a ticket of or near that price."Rather than any single factor, it is a badly damaged civil society that lies at the core of Italy's problems, making the prospects for reform dim indeed. Whether Monti's technocratic government is capable of reversing a strongly entrenched culture of corruption and illegality in short order may remain an open question, but the difficulty and magnitude of the task at hand is quite clear. The early direction of reform leaves much to be desired and the quick closing of ranks among unions and trade associations, some of which reportedly have ties to organized crime, suggests that achieving meaningful change in Italy will perhaps beyond the abilities of the disinterested, coddled political class. For the world's second largest bond market, the way forward looks uncertain and treacherous.

An excellent article and I would agree with much of its contents and the points it makes.

ReplyDeleteItaly really does need to change mentality to get onto the right track and this will not be easy by any means.

Time will tell.

Best,

Alex Roe

PS The mafia presence in Turin is by no means moderate.

ReplyDeleteHi Alex,

DeleteGlad you liked the piece and thanks for your support. Not surprised to hear there is a very active presence in Turin (the Juventus scandal suddenly came to mind...).

Thank you for sharing valuable information. Nice post. I enjoyed reading this post. The whole blog is very nice found some good stuff and good information here Thanks..Also visit my page Affordable Accountants Auckland Intouch Accountants aims to provide an affordable, timely, clear and concise accounting service for small and medium businesses.

ReplyDelete