|

| This could hurt a bit |

“Men!” announced the baneful god of Pannon memory

"I give to you a joyous land; yours to fight for, if necessary”

So great, brave nations fought determinedly for her

Until the Magyar finally emerged as the bloody victor

Oh, but discord remained in the souls of the nations: the land

Can never know happiness, under this curse’s hand"19th century Hungarian romantic poet Mihály Vörösmarty, expounding on the ill fortune that has so frequently cursed his native land.

Hungary has been getting a lot of press lately as its looming debt and balance of payments crisis continues to intensify, with Fitch lately joining S&P and Moody’s in downgrading the former Republic of Hungary (now just Hungary) to junk. I've taken an interest in Hungary in the past few months as it offers an interesting play on European deleveraging while its increasingly erratic and isolationist administration has provided some of the most exciting political theater to date in the Euro crisis.

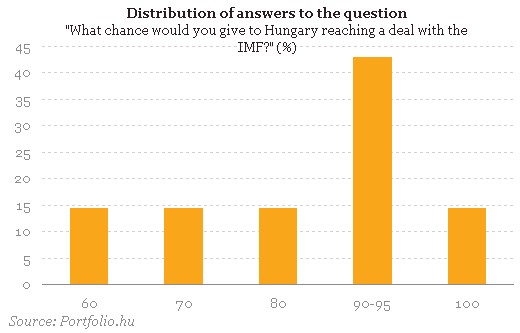

With the situation beginning to spiral out of control after a disastrous bond auction and an ever-weakening domestic currency, Hungary will likely need outside assistance similar to what it received in 2008 in order to arrest its slow but steady downward trajectory. In light of the potentially dire economic consequences, the analyst community seems to regard an IMF/EU deal as a foregone conclusion, having taken at face value the government’s recent comments on its willingness to negotiate in good faith.

|

| 10 Yr. Yield (L) USDHUF/EURHUF (far right), 5 Yr. CDS Spread (R) |

The government’s position remains rigid; its world view, either delusional or willfully deceptive and manipulative. In a recent WSJ piece issued after the announcement of the new constitution, Zoltan Kovacs, the Minister of State for Government Communication, continued to blame the previous Socialist government for the country’s economic woes, claiming that Fidesz is simply acting in accordance with its mandate by asserting its independence against the meddling hands of outsiders. According to Kovacs, hard times call for hard decisions and Fidesz is simply acting in the national interest as it struggles to undo the legacy of almost a decade of socialist rule. I’ve previously mentioned the problems of IMF aid in the context of the December summit agreement and the much discussed €200bn IMF package for Europe. Deploying IMF money is a politically tricky negotiation process in the best of circumstances, which strongly limits its efficacy as a timely backstop in an emerging crisis. Hungary is perhaps the perfect example of why the expansion of IMF aid should not give markets much comfort in the near term. Negotiations must bridge an enormous gap between an aggressive and stubborn government that faces little danger of being deposed and a distracted EU/IMF that already has its hands full and which has already been spurned several times by Orban & co. Recipients of IMF aid usually land in the position they do because of bad policy (although external circumstances certainly play a part too), and when those responsible for such policies remain in power the process of reform involves an embarrassing admission of failure by incumbents. After some clever electoral reform and a significant existing mandate, there is little short of a full revolution that would force Orban from power, allowing him significant room to further bungle things before he can be stopped.

So, lets briefly review the current situation before discussing the prospects for an IMF/EU bailout:

With gross government debt at ~80% of GDP and sizable gross foreign debt of 135% (1/3rd of which is FX denomed, including 70% of domestic mortgages and more than a third of government debt), Hungary is vulnerable to a classic balance of payments crisis should external confidence evaporate, as it is one of the most open economies in the world, with foreign trade constituting 150% of GDP, roughly split between imports and exports. Household leverage is comparatively low by Eurozone standards (36.8%/GDP against a 65.2% EU avg.), although almost 2/3rds of this is in foreign currency denominated loans (~70% mortgages, EUR & CHF denom'd.) and without a personal bankruptcy code there is little outlet for immediate relief. Corporate debt is higher at 61% of GDP, with almost 60% of the total debt being FX loans.

The narrow current account surplus remains vulnerable to slowdown in the broader EU, with ¼ of exports going to Germany, and around 5% going to Italy, Austria, the UK, France, the Netherlands, and Sweden each, although there is admittedly more diversification in the ultimate destinations of finished goods. Despite having an unusually high portion of high-tech exports, there is a substantial cyclical component, with almost 1/3rd of exports composed of transportation equipment. A European slowdown would hit Hungary hard:

The narrow current account surplus remains vulnerable to slowdown in the broader EU, with ¼ of exports going to Germany, and around 5% going to Italy, Austria, the UK, France, the Netherlands, and Sweden each, although there is admittedly more diversification in the ultimate destinations of finished goods. Despite having an unusually high portion of high-tech exports, there is a substantial cyclical component, with almost 1/3rd of exports composed of transportation equipment. A European slowdown would hit Hungary hard:

|

| German/Hungarian Industrial Production + Correlation |

Indeed, without the benefit of a robust rebound in exports the domestic economic situation would look a LOT worse:

A slowdown in European trade (itself benefiting from unsustainable Chinese demand) would be extremely challenging as the domestic demand picture remains weak. The availability of cheap EUR and CHF financing in the good years encouraged households and businesses (as well as the federal and local governments) to build up sizeable foreign currency debts to an extent not seen elsewhere in Europe, the unstable Baltic states excepted. Without the crutch of cheap financing, domestic demand remains anemic, with retail sales and construction activity well off their pre-recession levels, and indeed the recent account surplus is largely explicable by imports failing to recover to the same extent that exports have:

The industrial outlook has taken a turn for the worse lately, mirroring broader global developments:

Aging demographics (pension expenditures climbing from 8.5% of GDP in ’00 to 10.9% in ’08) and a slowly shrinking population (down 2% since 2000) create further structural headwinds. These come on top of a weak domestic labor picture, with unemployment near 11% and the second lowest labor force participation in the EU at 56% (with women and young people disproportionately disenfranchised), ahead only of lowly Malta, while more than 12% of Hungarians are on long term disability pensions against an EU average of 5.8%.

|

| Exports (green) vs. imports (red) and ratio imports/exports |

Aging demographics (pension expenditures climbing from 8.5% of GDP in ’00 to 10.9% in ’08) and a slowly shrinking population (down 2% since 2000) create further structural headwinds. These come on top of a weak domestic labor picture, with unemployment near 11% and the second lowest labor force participation in the EU at 56% (with women and young people disproportionately disenfranchised), ahead only of lowly Malta, while more than 12% of Hungarians are on long term disability pensions against an EU average of 5.8%.

Economic openness via trade is mirrored in the financing of the domestic economy, with non residents holding about 40% of government securities and more than 80% of the banking system comprised of subsidiaries of Western European banks, primarily vulnerable Austrian and Italian banks. A détente negotiated by Gyurancsy limited earlier deleveraging but given the recent political direction and the ongoing European funding crisis, continuing domestic credit contraction seems likely. After being hit with a punitive tax and being forced to eat the difference on the forced conversion of FX denominated mortgages, and with western European regulators already encouraging banks to restrict their lending to Eastern Europe, further domestic deleveraging seems fairly inevitable. The domestic consumer credit picture has looked fairly dire of late (although some of this is due to the FX loan program):

|

| From top: Household mortgage credit, consumer credit, and other household credit (Source: MNB) |

The situation in corporate credit is similar:

This trend seems likely to continue as loan losses mount:

With a European slowdown looming, the collapsing forint will likely provide little relief and is anyhow offset by mounting FX debt, with a 10% depreciation adding about 70bn HUF p/a to household debt burdens. This is mirrored by a similarly negative liquidity dynamic for domestic banks, as reflected in central bank stress test of an exchange rate shock (the assumptions of which are rapidly materializing, with EURHUF closing at 314.35 on 1/6):

Already weak domestic demand and continued credit deleveraging make the sovereign debt situation worse. With that worrying little snapshot of Hungary’s economic vulnerability, we now move on to the funding problems:

Despite the fairly formidable economic headwinds, the Hungarian government's near term funding problem doesn’t seem to be terribly acute at first glance, with only around €5bn in FX financing required against total government financing needs of €13bn in 2012. However, as previously alluded to, the government’s financial picture, bad as it is, is only a fraction of the overall problem. Optimistic observers have highlighted Hungary’s narrow current account surplus, coming as it does after years of deficits, and its good sized pile of FX reserves (€37bn at last count). However, the positives largely end there. FX reserves are flattered by the receipt of the €20bn of IMF money, repayments of which begin this year, while the current account seems to be showing signs of reversing as Europe slows. A worsening export picture and continued deleveraging will accelerate this trend. As Magdalena Polan at Goldman has highlighted, this is all very ominous in light of the funding needs of the private economy:

With looming contraction, tightening the budget deficit will prove difficult, particularly after a large 2006 deficit programme and the recent Szell Kalman plan, inadequate as it is, which has cut most of the low hanging fruit. The Orban administration has relied on a number of one-off measures to massage the deficit figures (including the nationalization of pension assets, crisis taxes, some temporary budget freezes, and the aforementioned bank levies) and has largely failed to address the structural issues that need to be fixed (i.e. administrative costs that are 50%> EU comparables, reducing transportation and drug subsidies, as well as cutting education and reforming the pension system) and more recent budgets have relied on laughably optimistic growth assumptions to make the numbers work. How the government plans to plug the >8%/GDP underlying budget deficit as the crisis taxes expire and the recent flat tax reform takes hold, which is likely to significantly reduce the tax burden of the wealthiest Hungarians, remains unclear. Meanwhile, with bond yields reaching credit card levels and an average duration of 4.5 years against a debt service burden of around 4% of GDP, things need to happen in a hurry. So, setting aside any and all political issues, resolving the public and private debt overhang is likely to prove a formidable task, even though it can be said that the public sector plays less of a role in the domestic economy than in some other European economies.

Having sketched out where we stand today and illustrated the urgency of the problems at hand, we now return to the prospects for outside assistance, ahead of Tamas Fellegi's January 11th meeting with the IMF (reportedly with Christine Lagarde herself):

I think an IMF deal is highly unlikely for a number of reasons, Orban’s recent backtracking notwithstanding. The raft of legislation pushed through recently by what has increasingly resembled a rubber stamp legislature represents the crowning achievement of Orban’s political career and was passed despite quite explicit warning from the European Commission, who have subsequently made clear that they will require a complete repeal of the most worrying legal changes before beginning meaningful discussions. The Commission is particularly concerned about the independence of the central bank but will undoubtedly find much to say about the new Constitution once it has time to fully digest the most offensive bits. With the ink barely dry on the newly drafted constitution repeal would amount to an enormous admission of defeat (at the hands of foreigners, no less) by Orban, who has gone through pains to reiterate to his base that the conspiratorial opinions of outsiders are irrelevant. A view into Orban's official position, excerpted from a recent interview from the Christmas issue of the conservative daily Magyar Nemzet (translation courtesy of the Contrarian Hungarian):

“Everything that is happening was brought upon us by the socialists’ governing and by their accumulation of a national debt beyond any measure… The problem is that, because of the crisis afflicting the entirety of Europe, the exchange rate of the forint is weaker, and this increases the amount of our debt. However, the fight against debt must be continued even during times of unfavorable exchange rates. This will bring visible and tangible results: when the crisis subsides and the forint recovers, our debt level will also drop…

The international journalists are right on a few issues, but their claims are falsehoods on most matters. Regardless, however, these news reports exist, and for this reason we must reckon with them... They go on and on that what is taking place in Hungary is not merely governing, but a regime change. They speak about this condemningly, but I think we should take it as a compliment instead. By the way, for more than a hundred years we Hungarians have been persistently unsuccessful at presenting our virtues to Western Europe.

Our goal is not to take out a loan from the IMF. To the contrary: we want to continue financing the economy from loans borrowed from the monetary markets. What we would like is for the IMF to enter into an insurance contract with us, in case the European money markets become paralyzed, which is not something one can rule out. In contrast to the situation and the hopes of a year ago, the euro zone is clearly unable to cope on the short-term with its own crisis.

One does not light a flame in order to hide it. We had to understand that we relate to the IMF as to a bank, and not as to a political organization. We do not consider aspirations they might have that go beyond expectations that a bank may set for its clients as a matter of course, these we can hardly accept. After all, Hungary is a country, an independent sovereign nation. If the IMF says that it expects economic policies that guarantee to them that they get their money back, that is a matter of course for us. The how [of setting up these policies, however] is up to us.

There is no need to get scared, to hide underneath the table – we must defend our position in open debate. Courage is not simply a character trait, but a form of life. By the way, it is possible that they may be fed up with us. Too much is happening in Hungary too fast, and every day someone reports us to them, driven merely from domestic economic and political motivations.”

This is not the voice of a man chastened by external criticism. Note the continued denial of any responsibility for the current circumstances.

|

| Orban: Not a good listener |

The credibility costs for the ruling administration being significant, having already previously attacked the IMF and denied the need for aid, Orban will be loathe to compromise. This was evident in the earlier November discussions, in which Orban reportedly insisted that Gyorgy Matolcsy (Minister of the National Economy) issue the public statement in an attempt to distance himself from the talks. Suggestions from the government that negotiations will be quickly and satisfactorily resolved seem delusional and fit the continuing pattern of denial of reality by the administration, which has been content with assigning blame to the previous government and to foreign conspirators (including an announcement that the secret service is pursuing action against speculators). The US, IMF, and European Commission have reportedly had enough and are likely to seek even more stringent terms than those offered in November. Meanwhile, Hungary awaits comments from the EC on its recent legislative actions, including a review of its media policy beginning on January 25th. Taken in this light, and given recent suggestions from the EU, any economic assistance seems highly unlikely.

Given the government’s previously erratic behavior and the lack of confidence in Orban, the Commission will likely require action and not mere promises from the Hungarian government. Manuel Barosso expressly warned Hungary about the dire consequences of proceeding with its aggressive legislative action and would severely jeopardize its negotiating credibility with other peripheral nations by backtracking:

To that end, the European Commission is backed by statements from France, Germany, and Austria, all of which have publically criticized Hungary’s new constitution. Given Hungary’s fiscal intransigence and its utter disregard for EU directives, not to mention that Hungary is not a member of the currency union (the preservation of which is above all the immediate priority), I think it is not unlikely that the Eurocrats get fed up and cut the aggressively uncooperative Hungary loose in order to better direct their resources elsewhere. From their perspective, this might not be the worst of things (the costs to Western banks notwithstanding) as it could potentially be used a warning to periphery nations that attempting to negotiate preferential treatment is not a viable strategy, and that the costs of doing so are potentially dire. Simply put, the gap to be bridged in negotiations is too wide, particularly given the unwillingness (and ultimately, the practical inability) of either side to actually negotiate.

Orban is extremely unlikely to accept the onerous terms that will inevitably accompany any sort of financial assistance, even those necessary for the much discussed ‘standby’ measures. His domestic political base secure, the government could in a pinch continue to ignore its international critics and begin tapping the FX reserves of the newly pacified central bank. While the long term costs (and the likely immediate impact stemming from a loss of international confidence as reserve balances draw down) of such a maneuver are clear, they may be perceived internally as offering the best option for maintaining independence (and the rule of Fidesz in turn) and plugging the holes in hopes of a later economic rebound. Indeed, I believe the timing of the central bank legislation, coming on the heels of the failure of the first round of IMF talks, speaks to this possibility. Despite the brief rebound in Hungarian bonds now that Fidesz has supposedly seen the light, those expecting a constructive outcome and an about-face from Orban are likely to be disappointed. Look for a breakdown in talks, further clarification from the EC/IMF, or a failure of one of the coming bond auctions (1/13 & 1/27, with several 3 and 12 mo. discount bill auctions in between) to act as the immediate catalyst for further weakness in the Forint.

Full disclosure: I have been and continue to be long USDHUF.

Just two minor, factual corrections.

ReplyDelete1. Although Hungary has an ageing society the rise in pesnion costs between 2000 and 2008 was manily due to the introduction of a 13th month pension, eliminated in 2009.

2. Even if the data 12% as percentage of the population with disability pensions is widely circulating it is not correct. Hungary has a bit less than 10 million inhabitants and as of November 2011 only 705 000 persons are enjoying disability pension or benefit. And the 12% is not correct even if one would compare it to the number of working age population as 392 000 persons among those with disabaility benefits are actually older than the normal age of retirement. The remaining 312 000 person make only 6% percent of the working age population.

So your point is the Orban will not flag and surrender, because he was talking harsh? I think no personality traits can play such a big role.

ReplyDeleteHe must make the deal with EU/IMF, he cannot risk full fledged currency crisis.

Before New Year's Eve he might have thought he could pull it off , the payables are far in the future and the EU crisis might subside. But last week he had to see that not making a deal ends in imminent disaster.

He is not tough enough to take the blow, his voter base would be so severely hit by a currency crisis. There are nearly 1 million indebted households and 1.5 million people with savings. All of them and their families would lose big time in a currency crisis which ended in bank runs. Disconnected from reality he is, but not that far.

Tapping FX reserves is not an option with EUR 50 billion foregin portfolio investment. It will turn out very very soon if they try it, because portfolio investment can be liquidated very soon.

ReplyDeleteHe would be forced to capital controls overnight, should the EU/IMF deal fail.

@ Gábor: Correct me if I'm wrong here, but from my understanding the 13th month benefit was only 165bn HUF, or about 60bps of 2010 GDP? As for your second point it would be very helpful if you could provide a source- my data here is admittedly not great. Do you otherwise agree on the overall picture of labor force participation?

ReplyDelete@ Lemmiwinks: You may be right. I just have a hard time believing that he didn't anticipate the immediate costs of pushing on with the new constitution. Despite Matolcy’s apparent surprise, the EU/IMF/US reaction was entirely predictable. If you’re willing to give him the credit to realize the urgency of the situation and do the right thing I think you’d need to credit him with the foresight to realize that this was always going to be the response. My point is that he has a lot of options if he wants to keep his hold on power, although none of them are constructive.

He still labels criticism of the CB law as being merely ‘political’, despite his statements that “maintaining or changing our earlier point of view is not an issue of prestige for us”. Perhaps he is creating room for some backpedalling but given everything we know about Orban I’m not yet willing to give him credit for having genuinely seen the light, not least because it seems increasingly likely that the IMF/EU will demand his head as a precondition to any deal. This fellow offers some excellent, more informed commentary on Orban: http://esbalogh.typepad.com/hungarianspectrum/

With respect to portfolio investment, about 2/3rds of that is in govt. bonds from my understanding. What about outright default before attempting to force borrowers to convert to HUF or eat a big upfront loss? You are right though in that Hungary’s inter-dependence with the EU will restrict Orban’s ability to act unilaterally.

I still think there are a lot of options on the table here, not least perhaps a covert deployment of reserves to buy back FX debt at a significant discount after a big gut wrenching move down. The bonds for the most part still trade at ~80+ on the dollar so this is not yet a viable strategy but could be in the near future…. This could likely be accomplished without any outward acknowledgement that Orban is pulling the strings and directing CB action. There have already been some rumblings within Fidesz about using reserves to ‘jump start’ growth. Anyhow, there a lot of permutations here but at the end of the day I think things will have to get worse (perhaps significantly) before we see a constructive resolution, whatever form it takes.

firstly, 312,00 is considerably more than 6% of the working age population unless we consider shild labour. Closer to 11%. This is a huge number.

ReplyDeletesecondly, while Fidesz inherited huge debt burdens from prevous mismanagement, including their own before 2002, they have done nothing to address one or two fundamental issues at the base of the original problem of over spening on the part of both the government and by private households. Three areas of overspending are the most obvious and seemingly most ignored. The huge and unnecessary civil service is a huge drain on public money with over 3000 majors and associated staff employed and with one of the largest parliaments per capita in the world. The second is the abuse of funds in public works projects, one example being the M5 extension which was one of the most expensive roads in Europe. A fair estimate would be that 25% of money for public works, and EU grant funded works disappears through invoice fraud and also sub sub sub contracting. The third is the huge black economy which benifits also from much of this "disappeared money" and the black economy stays separate from the legitimate economy thereby increasing the need for higher taxes, higher VAT, thereby further choking real domestic consumer spending. Until these issues are faced openly and honestly and the culprits held to account, including BANKS, fidesz, socialists, other politicians, and big business in hungary who incidently have a nice new tax cut while small business is now being choked to death, then there will be no real economic recovery possible.

I can only hope that the EU doesn't want Orban's head. This is impossible given his very strong hold on power, they should start a shooting war to achieve this.

ReplyDeleteAnyhow things always look more catastrophic when inside the crisis like now. Extreme scenarios suddenly look viable.

I mostly worried about the Fidesz MPs. They are way too incompetent to understand that fiddling with FX reserves is not an option. Actually I think they forced the insane "final repayment" law. The problem is I don't know how much power the Fidesz backyard has over Orban.

Outright default: I don't think so. This would impact the banking sector, so households and voters. Capital control is a kind of soft default impacting foreign holders only.

He is only interested in staying popular. Any kind of currency crisis, default would destroy his popularity. With absolute legislative power he could as well abolish democratic elections, why bother with bankrupting the country and risk the Gadhaffi treatment?

That had been my dilemma all year this year. He is to soft to become a dictator, but has the balls for impoverishing the country?

Yeah- I think you've hit the nail on the head here. This is where things begin to hinge on how well politicians actually understand markets.

ReplyDeleteHello. fantastic job. I did not expect this. This is a impressive story. Thanks!

ReplyDeleteProthane 1-204 Red Control Arm Bushing Kit