China posted trade data for January today, following up on a flurry of interesting data points:

|

| YoY Exports (White line) & YoY Imports (Blue line) - 2006-2012 |

Despite the focus on the potential drag from a European slowdown on China, exports, which were stagnant year over year, are essentially beside the point. The real issue is the unsustainable domestic investment economy and with exports flat YoY and imports down 15% YoY this is a terrible data point. There as been a lot of discussion about the comparability of the data owing to the impact of the New Year’s holiday (although the Customs Administration does seasonally adjust their figures), but I believe there is an increasingly clear downward trend in the more reliable data available. For those not up to speed, this is my perspective on China. It is not positive. I’ll return to the bigger picture in a moment, but for now I’d like to return to a subject previously discussed here.

For those following up on my AUD short, its worth noting a few relevant figures here, neither of which bode very well for Australian terms of trade, and by extension the Aussie dollar: iron ore volumes were down 13.9% and down 23.3% in USD terms. From a terms of trade perspective, and as highlighted in my previous post, the pricing slump is the more concerning matter as the Aussie commodity boom has been driven by pricing rather than volumes. Sadly, China does not offer numbers on coking & thermal coal, but I’d expect that if they did the figures would be similar. Chinese imports from Australia on the whole were off almost 15% in dollar terms, in line with the overall economy, with exports to Australia climbing 11%. Looking elsewhere in Asia, Japan and India led the pack with Chinese imports from those countries falling 35.7% and 37.4% respectively. The Indian number is especially interesting for those with an eye on iron ore, as it comprises more than half of Indian exports to China. (As an aside, it is also worth mentioning that Australia's Q4 data shows home prices down almost 5% YoY - this week's bull run on the RBA's failure to cut rates as anticipated notwithstanding, I believe the AUD is at or near what will likely mark a peak)

Back to the recent data releases: an unexpectedly high inflation number also hit the tape today, which seemed to undermine the consensus view that second half easing from the government will arrive just in time to offset any weakness, leading to a forgiving ‘soft landing’. Despite universally loathing the idea of economic management in their own economies, the Western market consensus has lazily swallowed the idea that state management rules out any potentially negative outcomes for China. I've discussed previously why this is a view not generally compatible with the history of Chinese economy but the ubiquity of this idea, and the degree of complacency contained therein, is fairly startling. However the CPI number, which many seem to take as the be all-end all of Chinese inflation, is not quite what it seems. The actual inflation outlook is worse, and the concerns expressed about the reduced potential of the government's ability to manage the economy are well founded. In fact, I think they've already lost control.

|

| Source: China Economic Information Network |

Inflation in China has always been a big deal for the regime and Chinese data is notoriously unreliable. With 2012 marking a pivotal transition year for the Party elite (and only the second peaceful transition in an increasingly bureaucratized party apparatus), it would be very surprising if there weren’t games being played with the figures. In this context, the re-weighting of the CPI basket to decrease the portion formed by food prices in the most recent release is not terribly surprising. Despite the overall CPI figure having retreated in recent months, boosting confidence that the government will ease in the back half of the year, food price inflation continues to accelerate, with worrying implications for domestic stability. As the helpful info-graphic from the Economist below illustrates, China is not a wealthy nation. Double digit food price hikes have a brutal impact on the daily lives of people and the unrest simmering in the background is not a coincidence.

|

| Source: The Economist It is also worth noting that labor earns a significantly smaller portion of GDP than in most other nations |

When China institutes measures to curb inflation, this is not just the standard suite of monetary tightening measures employed by Western central banks. It also includes a wide variety of price caps and pressure on businesses to not pass through inflation to consumers. So if we set aside the central bank gaming the CPI basket, its worth remembering that consumer prices in China are not the same as consumer prices in other, more open economies. One workaround to the apparent shortcomings of CPI is to look at the GDP price deflator, which offers a more realistic view of inflation, albeit still one that is not wholly immune to government 'adjustment'. The picture it paints is not a pretty one and suggests that inflation is likely 1.5-2x what the government says it is:

|

| Source: National Bureau of Statistics |

China has a long history of problematic inflation and to the extent that the economy has become increasingly reliant on domestic investment spending, Chinese policymakers face a dire challenge. In the wake of an enormous investment bubble the domestic economy cannot be slowed without risking having it collapse in on itself, but to continue pressing forward risks further inflationary pressure, which is equally if not more frightening for the regime than a halt to break-neck growth. It is worth mentioning that the current inflationary period has occurred despite credit growth persistently slowing since late 2009:

|

| Total Loans of Chinese Financial Institutions, YoY, 2006-2012 Source: China Economic Information Network |

If the history of Chinese banking is any guide, a significant portion of these loans (if not the majority) will go bad. Add back the unreported inflation and adjust for bad loans and the idea that 6% real growth is the downside case for China seems hopelessly naive. The fact there have been no material changes to the capital allocation system in China in decades and that credit decisions are still more a function of politics than any sort credit analysis suggests that this is little reason to believe that this is not the case.

Speaking of slowing growth, here's another piece of numerical food for thought, courtesy of Nomura via FT/alphaville:

Excerpted from Nomura's commentary:

"In the last 10 years CNY [Chinese New Year] has often fallen in different months in consecutive years, which leads to swings (trough to peak in Figure 1) in the year-on-year data. However, we have not (ex-2009) seen an actual decline in electricity production since 2002. We therefore believe that this drop reflects a sharp slowdown in industrial production."

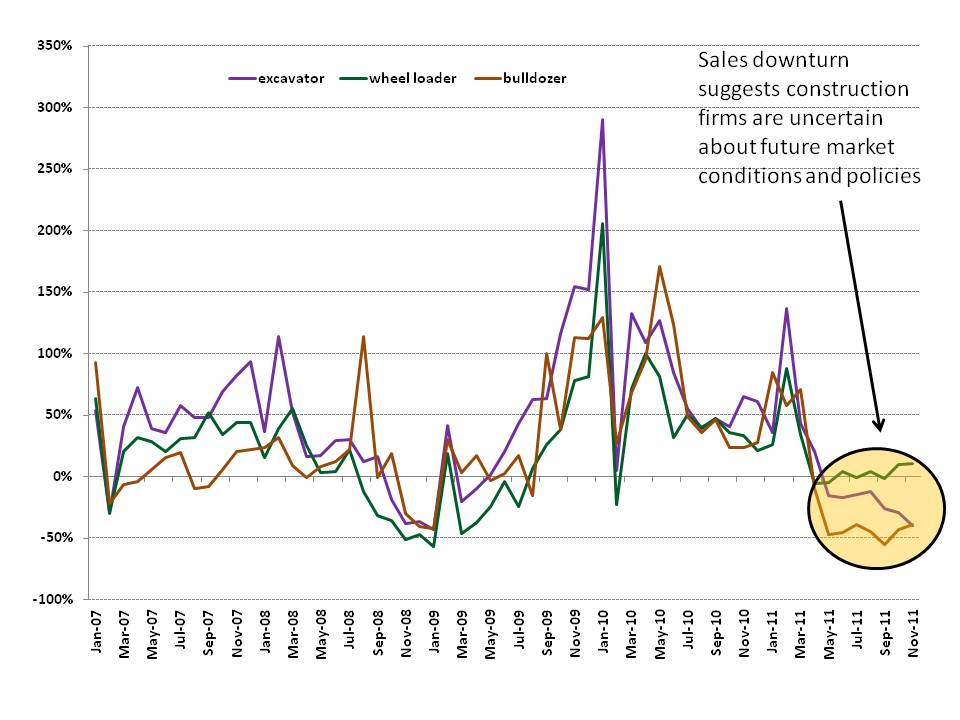

2002, eh? That would be around the time when Chinese banks were in the final stages of a massive re-cap in the form of what is possibly the largest accounting fraud ever perpetrated (see slides 44-51 for a primer), and right before China started to enter the Western consciousness as a bottomless source of hockey-stick growth. Other, non-manipulated data tells a similar story- check out the sampling of excavator sales data recently posted over at China Sign Post:

In this light, I am less inclined to draw the same optimistic conclusion that Reuters does here ("China PMI tops forecast, hard landing fears ease") in discussing the 20bp bump to PMI from December to January. 50.5 is still a weak reading and let's not forget that the PMI is a survey compiled from the responses of 700 large (and therefore primarily state-owned) businesses, so I tend to assign less weight to it as is.

China's problems are not new- they have been building for more than a decade and there is no simple solution here. The problems originate in a decrepit capital allocation mechanism in which all money flows through the hands of party-dominated banks but are pervasive throughout the state-dominated economy. In fact, I believe we've long since passed the point of no return. The more interesting question in my mind is whether or not the Communist Party is capable of surviving the consequences of their economic mismanagement, or whether China will undergo another jarring regime change as the party loses credibility in the coming years. 1912, 1949, 2012?

Well i have to say very good and amazing idea that you are giveing to us

ReplyDeleteand we are all very much insipred by your work and

i would like to share a website which has the same kind of product in our country

GMA SHOWS